rhode island state tax withholding

Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and ensuring public confidence. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

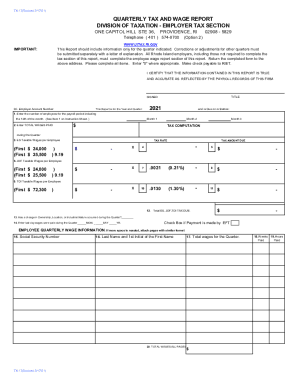

RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI.

. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state. No action on the part of the employee or the personnel office is necessary.

If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the difference. The annualized wage threshold where the annual exemption amount is eliminated has changed from 231500 to 234750. In Rhode Island there are five possible payment schedules for withholding taxes.

The purpose of this Part is to implement RI. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 4015748970 Withholding tax forms now. By election of the installment method the seller agrees to make such estimated payments and to file all appropriate Rhode Island tax returns for years following the year of sale.

The income tax withholding for the State of Rhode Island includes the following changes. The mailing address for tax returns payments and other correspondence for the Employer Tax unit is now. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

The annualized wage threshold where the annual exemption amount is eliminated has increased from 221800 to 227050. If you have any questions please call our customer service team at 401 574-8484. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

The income tax withholding for the State of Rhode Island includes the following changes. Find your income exemptions. Thank you for using the Rhode Island online registration service.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Additionally employers in other states may wish to withhold Rhode Island income taxes from wages of their Rhode Island employees as a convenience to those employees.

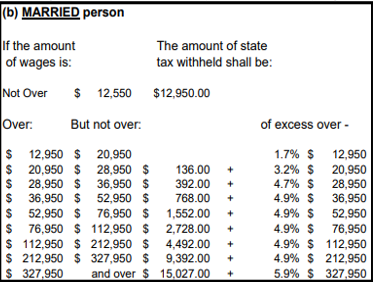

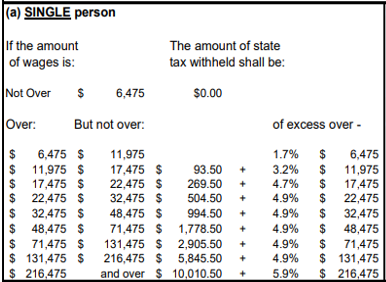

Over 68200 but not over 155050. If you are not ready to transition to the Tax Portal we also support various legacy. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Additionally employers in other states may wish to withhold Rhode Island personal income tax from wages of their Rhode Island employees as a convenience to those employees. 8 rows 375. WEEKLY - If the employer withholds 600 or more for a calendar month.

RI Department of Labor and Training. Laws 44-30-713 which provides for withholding of income tax on the sale of real estate by nonresidents. In ADV 2021-11 the Rhode Island Division of Taxation announced that it has extended through July 17 2021 previously extended through May 18 2021 emergency regulations that temporarily waive the requirement that employers withhold Rhode Island state.

Office of the Governor Secretary of State RIgov Elected Officials State Agencies A-Z State. Find your gross income. Up to 25 cash back File Scheduled Withholding Tax Payments and Returns.

Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax. Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. Effective April 11 2022 the Employer Tax unit transferred from the RI Division of Taxation to the RI Department of Labor and Training.

Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. Effective July 11 2022 this site will be deactivated and users will no longer be able to access historical information. Your payment schedule ultimately will depend on the average amount you hold from employee wages over time.

The Rhode Island Division of Taxation has a new web portal httpstaxportalrigov. REPORTING RHODE ISLAND TAX WITHHELD. 255750 plus 475 of excess over 68200.

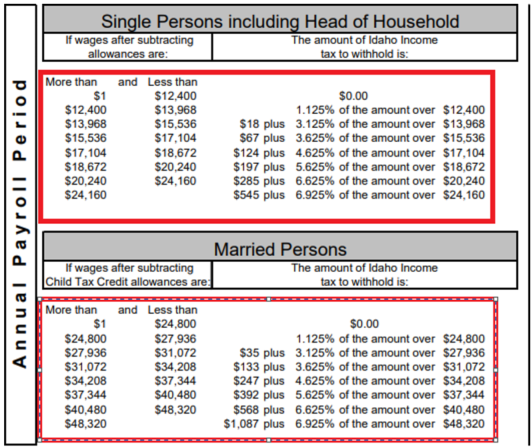

The income tax is progressive tax with rates ranging from 375 up to 599. The income tax withholding for the State of Rhode Island includes the following changes. The income tax wage table has changed.

Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. We allow for estimated payments extension payments payments with a tax filing license renewal payments bill payments and payments for various fees. If you need help getting started feel free to call us at 4015748484 or email at taxportaltaxrigov.

RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. The annual taxable wage table has changed. Find your pretax deductions including 401K flexible account contributions.

UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Daily quarter-monthly monthly quarterly and annually.

State of Rhode Island. No action on the part of the employee or the personnel office is necessary. Rhode Island extends COVID-19 income tax withholding guidance for teleworkers.

A resident is defined as anyone who is domiciled in the state or who spends 183 days of a tax year in the state.

Pass Through Entity Election Ri Division Of Taxation

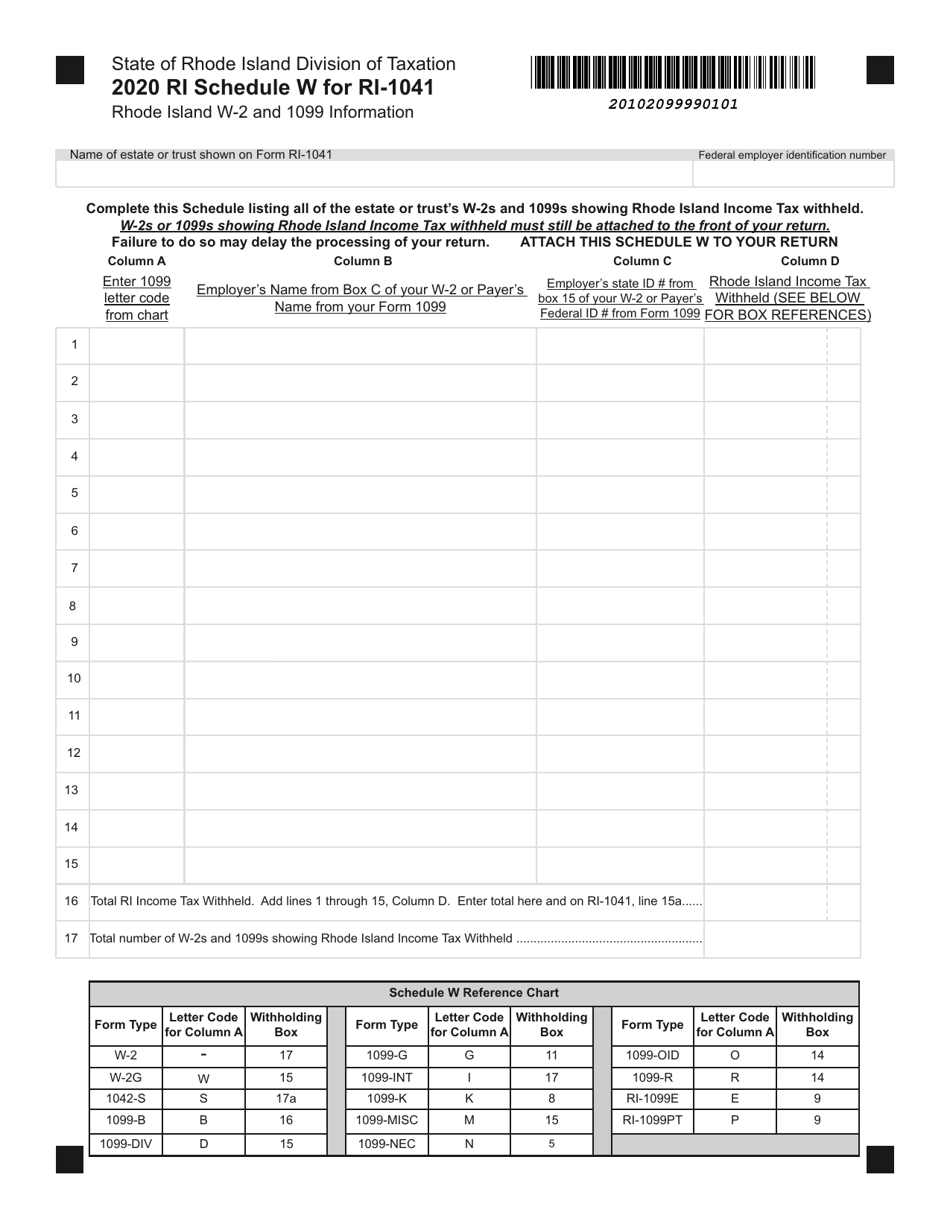

Form Ri 1041 Schedule W Download Fillable Pdf Or Fill Online Rhode Island W 2 And 1099 Information 2020 Rhode Island Templateroller

Form Ri 1120s Business Corporation Tax Return Youtube

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Form Ri 1041 Schedule W Download Fillable Pdf Or Fill Online Rhode Island W 2 And 1099 Information 2020 Rhode Island Templateroller

About The Ri Division Of Taxation Ri Division Of Taxation

2021 Form Ri Tx 17 Fill Online Printable Fillable Blank Pdffiller

2021 Form Ri Tx 17 Fill Online Printable Fillable Blank Pdffiller

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

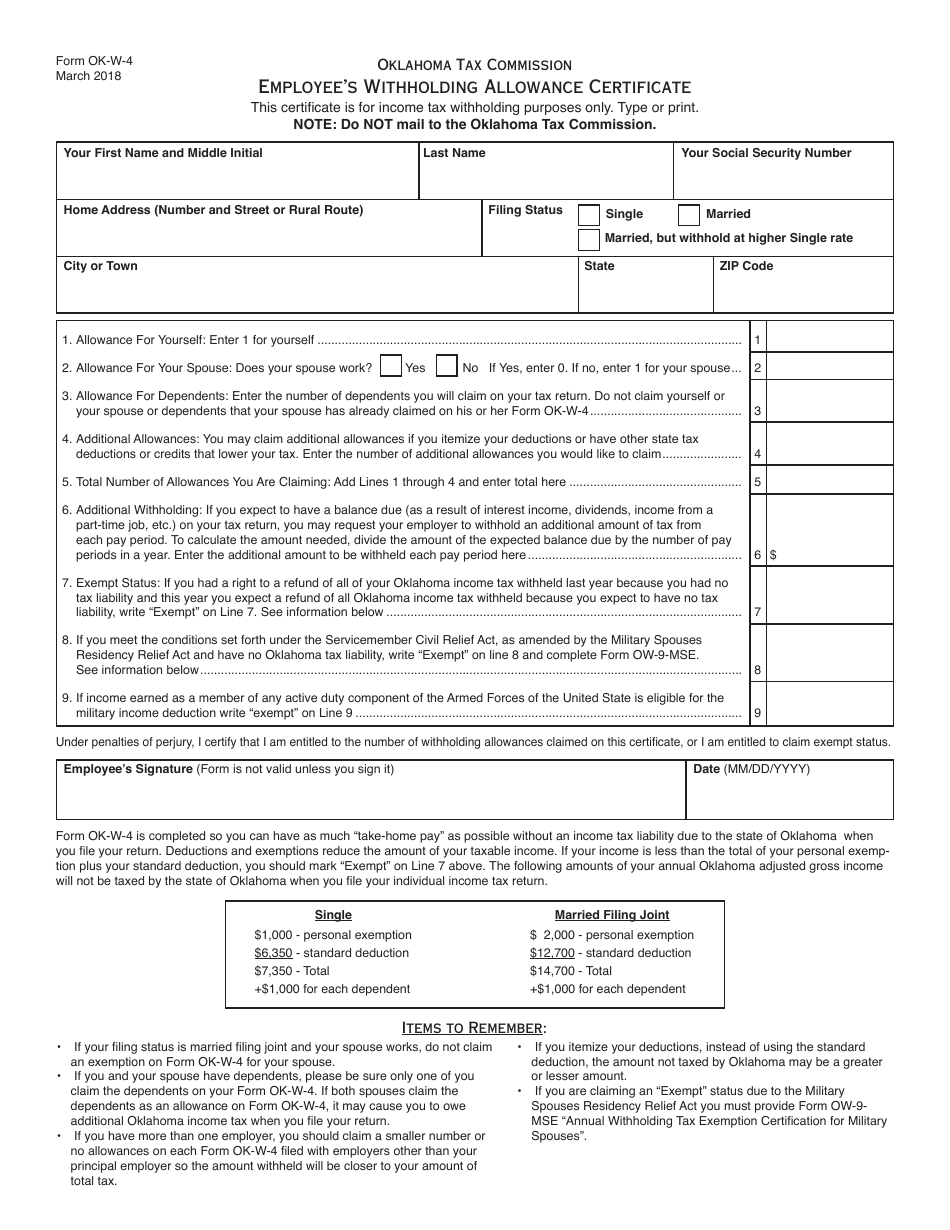

Otc Form W 4 Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Oklahoma Templateroller